If you think of your financial portfolio as a toolbox, certificates of deposit (CDs) are like the hammers. They’re not the fanciest tools, nor do they produce the most wow-worthy results, but they are solid and dependable. In addition, when using investment strategies such as CD Laddering you can earn a higher blended rate and keep your funds more liquid.

“CDs complement any financial portfolio as they typically pay a higher rate of return than a money market or savings account, and the principal plus interest is guaranteed at maturity,” says Julie Nelson, senior vice president of business development for American Bank & Trust. “CD’s can also offer many maturity options to best fit each depositor’s financial goals.”

The investment strategy CD laddering

For maximum CD flexibility and earnings, you may want to consider building a CD ladder. This strategy allows you to reap the higher interest rates of longer-term CDs while still having access to your funds at regular intervals without penalties.

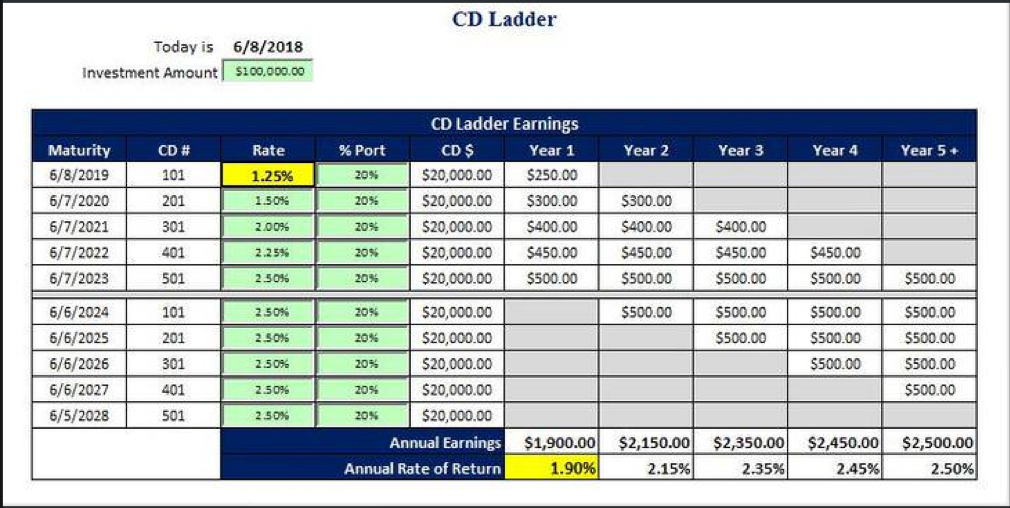

To learn how it works watch this video or read on – Instead of investing all of your money into one CD, you instead divide it between several accounts that have staggered maturity dates. For example, if you have $50,000, you could distribute it between five $10,000 CDs maturing in one, two, three, four and five years. That way, each year you have the option to withdraw money if necessary. If not, you can reinvest it in a longer-term CD that has a higher interest rate, and you have the security of knowing you’ll have another CD maturing the following year. Each time a CD matures, you have the opportunity to reinvest it at a higher interest rate, thus building a ladder to greater savings rung by rung. See the example below –

With this CD Ladder example, the first year blended rate of return is 1.90%. This blended rate of return is 0.65% higher than the 1 year CD rate of 1.25%. After your CD ladder is completely built, you will have 20% of your money available to you each year and be rewarded with higher rate of return associated with longer-term CDs. CD ladders can be built on one-year increments, like the above example, or shorter or longer terms such as 6 months or 18 months.

CDs explained

Similar to savings accounts, CDs are tools offered by financial institutions to help you save money while earning interest. The difference, however, is that with CDs, you agree to leave your money in the account for a set period of time, until the CD matures. If you withdraw your money before that maturity date, you have to pay a penalty. CD terms range from 3 months to 5 years, and the longer the CD term, the higher the interest rate you’ll get.

American Bank & Trust provides an online CD calculator so you can see just how much your money will grow in a CD given various terms and amounts deposited.

CD Pros and Cons

To determine if CD might be right for you, consider the following:

Predictability

CDs are predictable. When you open a CD, you lock in an interest rate. No matter what happens in the market, you’re guaranteed a return on your money at that rate.

Risk factor

Because they’re insured within the FDIC guidelines up to $250,000, CDs are virtually risk-free. They may not pay off as well as the stock market (on a good day), but you also won’t have to worry about the market’s volatility. Staff at American Bank & Trust offer assistance in ownership and beneficiary structuring, to ensure that balances in excess of $250,000 are fully insured by FDIC.

Interest rates

In exchange for committing your money to a CD for a set period of time, financial institutions typically offer higher interest rates on CDs. The longer the term of the CD, the more competitive the interest rate offered.

For example, American Bank & Trust offers both short-term and long-term CDs that currently include options such as a 17-month CD with a 2.17% annual percentage yield (APY) and a 47-month CD with a 2.47% APY. You can open one with as little as $500.

Community interest

While CDs are a strategic investment in your financial future, they may also serve as an investment in your community. “CDs deposited at community banks, such as American Bank & Trust, are re-invested locally in the community through personal and business lending,” Nelson said. “This has a positive impact on the local economy in each of our communities.” In other words: Win-win.

Fluidity of your funds

The downside to CDs is, of course, that if you need to withdraw your money before your CD expires, it will cost you. “If there’s a need for liquidity, a money market account would be a better option,” Nelson says. “Or you should tailor the maturity of the certificate to accommodate your financial obligations.”

On the flip side, however, that penalty can also serve as a deterrence to spending money on expenses that may not be truly necessary, as you’ll probably be more likely to rethink a withdrawal if you have to pay a penalty.

Bottom line

While there are investment strategies that may pay a much higher rate of return than CDs, they also typically come with a lot more risk. CDs offer a safe, reliable and flexible savings strategy to help you achieve your financial goals. Contact a banker at American Bank & Trust for more information about how they can work for you.https://www.abt.bank/contact/