June 12, 2020

Paycheck Protection Program – Loan Forgiveness Updates

We’d like to share some additional Paycheck Protection Program (PPP) loan forgiveness updates. On June 5, Congress approved the Paycheck Protection Program Flexibility Act of 2020. This bill is intended to provide businesses with more time and flexibility to keep their employees on payroll and to aid their continued operation. You can read the press release announcing the passage of the legislation here.

We now are awaiting final guidance from the SBA regarding program changes to help borrowers and lenders navigate the forgiveness process. At this time, there are still some unanswered questions, but be assured that American Bank & Trust will be here to help you through the process and keep you updated with relevant rules and guidance

Some highlights of the PPP Flexibility Act include:

- Extending the Covered Period from the current 8 weeks to 24 weeks, but allowing borrowers who already have a PPP loan to retain the option to use an 8-week Covered Period

- Easing the amount that must be spent on payroll from 75% of loan proceeds to 60% of loan proceeds

- Extending the time a PPP borrower has to restore Full-time Employee (FTE) counts until December 31, 2020

We continue to monitor progress to stay in front of the changes and will continue to communicate with you when we receive updated final guidance and are ready to take forgiveness applications. At this point, there is currently no deadline for borrowers to apply for forgiveness.

The SBA, in conjunction with the U.S. Treasury, will be issuing a modified loan forgiveness application to reflect the legislative amendments to the PPP. Until the modified application is available, please review the preliminary application, as it lists the required supporting documentation, as well as what is to be retained by the borrower. Here is a link to the preliminary loan forgiveness application that was first released on May 15. This is the best information that we have, to date, that refers to forgiveness and the documentation required. As you plan for forgiveness of your PPP loan while application materials are finalized, continue to document your use of funds on eligible expenses.

More information surrounding the forgiveness process will be shared to help you navigate the process as easily as possible. We are working hard to ensure that our process will be a clean and successful method.

As always, you can reach out to any of our bankers with any additional questions. Thank you again for choosing American Bank & Trust with your PPP and banking needs.

May 21, 2020

Economic Impact Payments (EIP) Debit Cards

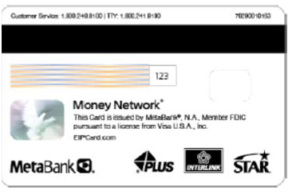

Economic Impact Payments, also known as stimulus payments, continue to be sent to people across the US. During the week of May 18th, some individuals who qualify for a payment, received a prepaid Debit Card with their funds. If the IRS did not have bank account information, and you did not receive a paper check, your funds will be made available through a Debit Card. This is what the Debit Card looks like –

Details on how the card works, how to activate, create and access your online account, and Frequently Asked Questions (FAQs) can be found at the website www.EIPCard.com.

April 16, 2020

Quick Reference Guide For COVID-19 Assistance Packages

Please click below to access a guide which provides an overview of the key government support initiatives to aid individuals and business owners mitigate the financial impact of the coronavirus pandemic. The information in the guide is subject to change as additional details emerge around how these programs will be implemented .

April 15, 2020

Looking For Your Stimulus Check? New IRS Tool Lets Tax Filers Update Direct Deposit, Track Progress

The Treasury Department and the Internal Revenue Service (IRS) have released a new web tool that will allow taxpayers to update their direct deposit information to receive their Economic Impact Payments more quickly. It will also allow you to check your payment status and indicate when and how you will receive payments.

The new tool, Get My Payment, will:

• Provide you with the status of your payment, including the date your payment is scheduled to be deposited into your bank account or mailed;

• Advise you of your payment type; and

• Allow eligible taxpayers a chance to provide bank account information to receive payments more quickly rather than waiting for a paper check. This feature will be unavailable if the Economic Impact Payment has already been scheduled for delivery.

You’ll be asked to enter a few bits of key information, including your Social Security Number, date of birth, and address. This information needs to match what the IRS has on file (with your last filed return). Have your 2019 tax return (if filed) and your 2018 tax return handy.

Checks are already hitting bank accounts. For security reasons, the IRS plans to mail a letter about the economic impact payment to your last known address within 15 days after the payment is paid. The letter will provide information on how the payment was made and how to report any failure to receive the payment.

Keep in mind that the payment is NOT taxable and will not affect your 2020 refund. Things are happening at a rapid-fire pace and additional information continues to become available daily. We will continue to update you with this information and invite you to check out our website at ABT.bank for additional updates.

April 1, 2020

CARES Act – Small Business Relief

The Coronavirus Aid, Relief, and Economic Security (CARES) Act was created to help small businesses keep workers employed amid the pandemic and economic downturn. The U.S. Chamber of Commerce created a Small Business Guide and Checklist to help you understand what is available and how to take advantage of this program. You can access this guide by clicking the button below.

The United States Congress recently approved nearly $350 billion to help small businesses keep workers employed amid the COVID-19 pandemic and economic downturn. The Paycheck Protection Program (PPP), which is part of the CARES Act, provides 100 percent SBA guaranteed loans to small businesses, non-profit organizations and other qualified entities. These loans may be entirely forgiven if borrowers meet program requirements. For questions on eligibility, or details of the program, access the Cares Act Small Business Guide and Checklist below or reach out to your banker with any additional questions. The Paychek Protection Program Application Form is accessible by clicking the ‘Application’ button below. Please return the completed form to your banker.