Not FDIC Insured | Not Bank Guaranteed | May Lose Value | Not Insured by any Federal Government Agency | Not a Bank Deposit

Celebrated author and journalist Tom Wolfe died in May at the age of 88. He wrote The Electric Kool-Aid Acid Test and The Bonfire of the Vanities, among many other notable works. Wolfe was survived by a wife and two children. His Will left his tangible personal property to his wife, and his residuary estate to a revocable living trust. The wife was named executor, and successor executors were also identified. That is all we know about the Wolfe estate, and all we are likely to know. The revocable trust can do many things, and one of the most important—especially for celebrities—is to provide a zone of financial privacy for distribution of assets.

Trust advantage

For generations, affluent men and women have turned to trust institutions such as ours for professional asset management. They come to us for investment guidance that is prudent, personalized, and firmly oriented toward long-term performance, not speculation. These days more and more clients establish their accounts as revocable living trusts. In these accounts, we act as trustee, guided by instructions contained in the living trust agreement. The popularity of trusts is rooted in the fact that they are just as flexible as financial agency accounts, while they offer major financial planning advantages. Ask yourself this: Do you need an assistant who can take the drudgery out of investment management and faithfully execute your instructions? Or would you prefer a partner who is ready to shoulder responsibility for your financial management whenever necessary?

You retain control

The popular image of trusts is that they “tie up” assets, and, in truth, sometimes trusts are used for just that purpose. For example, “spendthrift trusts” can be used to provide a measure of long-term financial support for debt-addicted heirs. Or a trust may be used to protect and manage the inheritance of a minor child. Or a trust can be used to divide property interests between private and charitable beneficiaries. There are countless comparable examples of the wealth-preservation uses of trusts. But as the creator of the trust, there is no purpose in imposing limits upon yourself. You retain the power to cancel the trust, to amend the terms of the trust, or to add or withdraw assets from the trust. In short, you’re in full control, just as you would be if we were acting as your investment agent instead of as your trustee.

Freedom from worry

With an agency account, you continue to own your securities as before. With a revocable trust, your ownership undergoes a subtle change. You and others you name in the trust agreement retain beneficial ownership of the assets while the trust that you control (thanks to your power to amend or revoke) holds legal title. Thus, despite its flexibility, the trust exists as an independent legal entity in the eyes of the courts. It is this status, as an independent entity, that creates additional, powerful planning opportunities. For example, what happens should a sudden, serious illness prevent you from supervising your finances? Or worse? You become legally incapacitated? Or not nearly so bad, you simply choose to spend six months abroad? In situations such as these, the living trust differentiates itself from ordinary investment accounts. Traditionally, agency accounts must end if the owner of the account becomes incapacitated. A trust, on the other hand, may continue for the benefit of the creator, even though that person is no longer able to act on his or her own behalf. Many of our clients take advantage of this planning opportunity by authorizing us, in their trust agreements, to provide full personal financial management in the event of their incapacity. That means we’ll be able to pay household bills, take care of taxes and, if need be, even arrange for housekeeping help or home health care services. Or we may begin to fulfill these duties in advance of the trust creator’s incapacity. The trust may spell out the circumstances, or the trust’s creator may simply ask us to take over full financial management responsibilities.

An estate planning dimension

An agency account must end at your death, and the assets become part of your probate estate, to be distributed under the terms of your will. The terms of every will become public in the probate process. A trust, by contrast, usually avoids probate. Hence, the privacy afforded to the Wolfe estate. In the trust agreement drawn by your attorney, you may instruct that all or some of the trust assets be distributed directly to the beneficiaries that you name. Or you may have the trust continue as a source of income and support for one or more beneficiaries—your spouse or child, for example. Revocable trusts do not save estate taxes. Most families will not need to be concerned about federal estate taxes for the next few years. Because you retain the power to amend or revoke the trust, the full value of trust assets will be included in your estate. However, the trust can be integrated into your estate plan to further tax-saving objectives. Trusts also provide a disposition plan that might otherwise be included in a will. A final note. Probate may be quick and easy, or it may not be. The validity of a will may be challenged, or it may not be. Living trusts remove some of this uncertainty because they can provide for distributions to beneficiaries immediately following your death. When a trust has been in operation during your lifetime with your approval, a legal challenge to your testamentary plans is much more difficult to maintain.

Call American Bank & Trust to see how trust services can help you and your family.

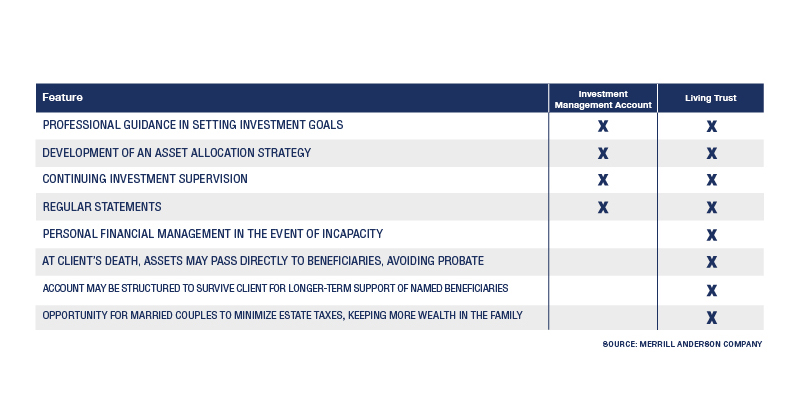

Which account is right for you? When the core advantages of ordinary investment management accounts and revocable living trusts are compared, the trust option looks very compelling.

Want to know more about this topic?

Subscribe to our newsletter today!